Any savvy lessee can tell you that the key to getting a good lease is “knowledge”. If you don’t know how to estimate payments, you run the risk of being fleeced by your salesperson. The only way to prevent this is to determine what a “realistic” payment is and try to work with your salesperson to achieve that. Realistic payment estimates are essential because no dealer will work with you unless they are able to make some money out of each transaction. Like us, they got bills to pay too. Below, your will see a few lease calculation examples that should help you with your negotiations.

Calculating Your Payment – Inception fees due at signing

The quickest way to estimate lease payments is to assume you will be paying your inception fees upfront. This way, your calculations remain simple and quick. All you need are the basics: MSRP, Sale Price, Term (in months), Residual Value and Money Factor. If you want to take advantage of the RWG rating, you will need to know your mileage allowance as well. Check out the example below:

2012 ACURA TL BASE

36 month | 15k miles | residual 61% | .00170 base money factor

MSRP – $36,490

Sale Price – $32,567 (TrueCar price minus $1000 rebate)

Monthly – $380+ tax

RWG Rating – 93.9

The assumption is that you will pay your inception fees upfront and keep it separate from your loan. Since the drive-off (inception) fees fluctuate depending on the cost of the vehicle, I generally assume it’s approximately $1500-$2000. Inception fees normally consist of the following: Your first month payment, Bank Fees, Dealer Fees, County/City fees, DMV registration and sales taxes associated to any rebates you are getting. In some states, you may have to include the sales tax for a portion of your lease depreciation or 100% for your vehicle’s value. For most states, sales taxes are calculated as an “use tax”, which is applied to your payment on a monthly basis.

Based on my location, my inception fees would amount to approximately $1335. Here’s how I estimated that:

DMV $315 (CA DMV Registration Calculator)

Bank Fee $595 (List of Bank Fees)

Dealer Doc Fee $45 (Capped in California, other states are uncapped so could be in the hundreds).

First Month Payment $380

Total Estimated $1335.

This number is actually low because there are extras fees associated with your DMV registration. In addition, cities will sometimes charge extra fees here and there as well. If the dealer does electronic filing of your registration, there will be a cost associated with that too. If that wasn’t enough, you also have to pay taxes on any rebates and any advertising fees that certain dealers charge (Think MACO and Training for BMWs). When it’s all said and done, expect to pay AT LEAST $1335. To be on the safe side, I like to estimate my inception fees to be in the $1500 range and if you pay advertising fees, it’s more like $2000. The best way to know what you are paying for is to have your dealer itemize these fees so you know exactly where your money is going.

Once you have determined what to expect (in this case, you are looking at a $1500 drive-off with a $380 monthly payment +tax) you will know what to tell your dealer when they ask you how much you can “afford” per month and how much you plan to “put down”.

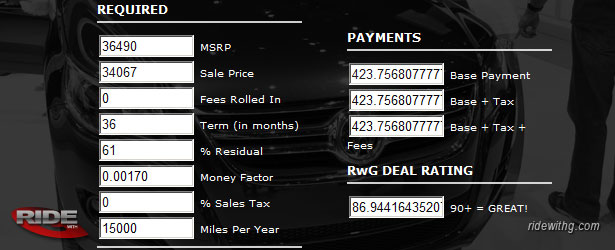

Calculating Your Payment – $0 Drive-Off

To get an idea as to what you would be paying per month on a $0 drive-off deal, you simply add-on the drive-off to your sale price. In this case, we know the sale price minus the rebate on the 2012 TL is $32567 and we estimated our drive-off to be about $1500. This comes up to a total of $34067 for your sale price (which we generally refer to as cap cost). In order to figure out the monthly payments, just plug the total into the sale price Fees to Roll In (thanks for the correction BD) field of the calculator and hit “calculate”. If you have to pay all your sales tax upfront, add that in there as well.

2012 ACURA TL BASE

36 month | 15k miles | residual 61% | .00170 base money factor

MSRP – $36,490

Sale Price – $32,567 (TrueCar price minus $1000 rebate)

Fees Rolled In – $1500 (Estimated inception fees)

Monthly – $424+ tax

RWG Rating – 93.5

One thing to note here is that this is a simplified approach, so your dealer’s numbers will vary slightly (usually a little higher). However, I think that you should be within reasonable dollar amount so it shouldn’t be that big of a deal.

It is more advantageous to do a $0 drive-off lease when the money factor is low. Please note that the $0 drive-off leases do take a very small hit on my RWG rating system (about 0.4 pts) and that is due to the fact that you are paying interest and taxes on items such as your DMV registration, bank fees, dealer fees, and so on. But in the grand scheme of things, those costs shouldn’t be too significant if your money factor is low.

RWG Rating System

The rating system I use is fairly straight forward. Anything above a 90 rating is considered a good lease. Ratings higher than 100 are exceptional. Ratings lower than 85 should probably not be considered. Personally, I would not recommend leasing anything below a 90 rating if getting more car for your money is a top priority. If you are willing to pay a little extra to get what you want, I wouldn’t go below 85. Please note that the rating does not take into consideration sales taxes and it also assumes you will pay your inception fees up front.

If you plan to use the rating system to compare $0 drive-off deals, make sure to do that for all cars to ensure a fair comparison. I would recommend adding $1500 to the sale price for all vehicles in the comparison to compensate for the usual drive-off costs.

How to Identify Good Deals

There isn’t a fancy way to figure out what makes a lease a good one. The best way to get a “DEAL” is to make sure at least TWO of the THREE main components of a lease are attractive. By components, I mean the following:

Residual Value. The first thing I look for is a HIGH Residual Value. I do not typically buy my cars at lease-end so leasing a car with a low residual value doesn’t make any sense. Because of that, I like to go for models that have residual values in the high-50% or low-60% on 36-month terms. I find 36-month terms to be optimal in terms of payments and wear-n-tear. 24-month are great, but may feel a tad short, while 48-month leases are too long and add too many unexpected expenses.

Money Factor. You want to keep this low so you don’t get charged too much interest on the loan. I usually shoot for leases with the “four zeros”, the ones that fall below 0.00100 or 2.4%. You can calculate the interest rate by multiplying the money factor by 2400.

Sale Price. An aggressive sale price is also a great way to keep your payments low. As you know, the size of your lease loan is determined by the difference between your sale price and residual value. If the gap between your sale price and residual value is low, the size of your loan will be smaller. This will also help keep the finance charge (money factor/interest) minimal, thus keeping your payments lower. Sale prices that are close to 10% off MSRP are probably the best. Any percentage above that is just icing on the cake. A good deal hunter would generally look for a vehicle that sells for a big discount (plus rebates and incentives), high residual value and low money factor. This combination typically yields the lowest monthly payments and gives us the most bang for the buck.

What’s a good example of a good deal? For the month of July 2011, the 2011 Infiniti G37 Journey Sedan looks very attractive. It boasts one of the higher residual values for 2011 models (58% @ 15k miles per year over 36-months) and has an easy-on-the-pocketbook 0.00058 money factor that breaks down to a low interest rate of 1.4%. The average sale price for this sedan in the Southern California region is 12% off MSRP and as of July 2011, there’s $1000 loyalty cash and $1000 dealer cash that’s available until August 1st, 2011. This certainly isn’t the only car that’s considered a good deal, but it’s one of them.

Here’s are some helpful links to get you started on how to estimate your own lease payments:

- RWG Lease Calculator

- Captive Bank Fees

- Lease Rates

- Local Sale Prices (TrueCar)

- Available Incentives (Edmunds)

Now go find yourself a good deal!